In this article, we will discuss the benefits of Tax Credit, new changes in Tax Credit, and updated Form 26AS for AY 2023-24. It is a statement of tax credit that contains details of taxes deducted or collected on behalf of the taxpayer and deposited with the government. Form 26AS Tax Credit Statements in India: A Comprehensive Guideįorm 26AS is an important document for taxpayers in India as it provides a consolidated view of their tax credits. If you want to download 26AS from TRACES website and go through different parts of your tax credit statement later, leave the format as PDF.In this article we shall take a look at what is form 26AS in the context of Income Tax and what is required while filing this form. In case you want to see it online, choose the HTML format. Now, choose the assessment year and format here to complete the process. Step 4: Next, a disclaimer will pop up, mentioning that you will be redirected to a third-party website ( TRACES portal) which you need to confirm to proceed further. Click on the 'Income Tax Returns' and then the 'View Form 26AS’ option consecutively from the dropdown.

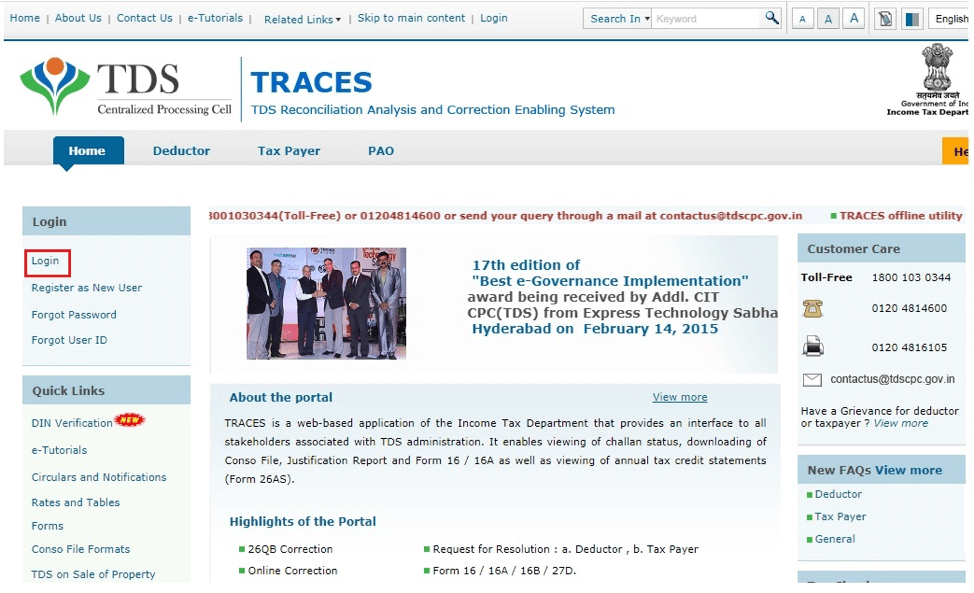

Now select the check box given to confirm secure access and enter password. Step 2: Next, enter your user ID (Aadhaar or PAN). Step 1: Visit the e-filling portal of the Income Tax Department to register yourself and begin the process. Want to keep a copy of your annual information statement? Follow the procedure mentioned below to download it. You can also use the Income Tax Department’s e-filing website and view Form 26AS with PAN, date of birth or date of incorporation, etc.In this regard, you must check if your bank is registered with NSDL and provide such facilities. You can use the net banking facility, where your bank account should be linked with your PAN.

There are two ways you can view 26AS online.

Now that you know what ITR form 26AS means, let us see the easiest way to access it and obtain the necessary information. Before filing your ITR, you must go through the statement once to check the tax amount deposited in your account.

0 kommentar(er)

0 kommentar(er)